Are you tired of throwing away your hard-earned money on rent? Are you dreaming of owning your own piece of property? If so, then you’ve come to the right place. In this comprehensive guide, we’ll delve into the age-old debate of buying vs. renting a home in India. We’ll weigh the pros and cons, explore the financial implications, and help you make an informed decision that aligns with your goals and lifestyle.

The decision to buy or rent a home is often more than just a financial consideration—it can be an emotional one, too. In India, where homeownership is culturally associated with stability, security, and success, deciding to rent might feel like going against the norm. Yet, with rising property prices, renting offers the flexibility many modern professionals crave. So, which option is right for you? Let’s explore in detail.

Buying a Home in India: A Deep Dive

Owning a home is a significant milestone for many Indians, symbolizing not just financial stability but also success. Yet, the decision to buy is a complex one. It involves long-term commitments, upfront costs, and plenty of planning. Here’s what you need to know about the financial and lifestyle factors that come with purchasing a home in India.

Financial Considerations

1. Down Payment

The most immediate financial barrier to buying a home is the down payment. In India, down payments typically range from 10% to 25% of the property’s price, depending on the loan structure and the bank. This can mean shelling out a significant amount upfront. Let’s say you’re looking at purchasing a home worth ₹50,00,000 in Jaipur. A down payment of 20% would be ₹10,00,000. That’s a significant investment upfront, even before factoring in other costs.

Tip: Start saving for your down payment as early as possible. Consider investing in fixed deposits or mutual funds to build a substantial corpus over time.

2. Closing Costs

While the down payment is substantial, the additional closing costs are also significant. These include registration fees, stamp duty, legal fees, and brokerage charges. Depending on the state you live in, these can range from 5% to 12% of the property value.

Breakdown:

- Registration fees in Rajasthan are around 1%.

- Stamp duty varies, often between 5% to 7%.

- Legal and brokerage fees add an extra 1% to 2%.

For example, in a city like Bangalore, closing costs can easily add ₹3,00,000 to ₹5,00,000 to the price of a ₹50,00,000 home.

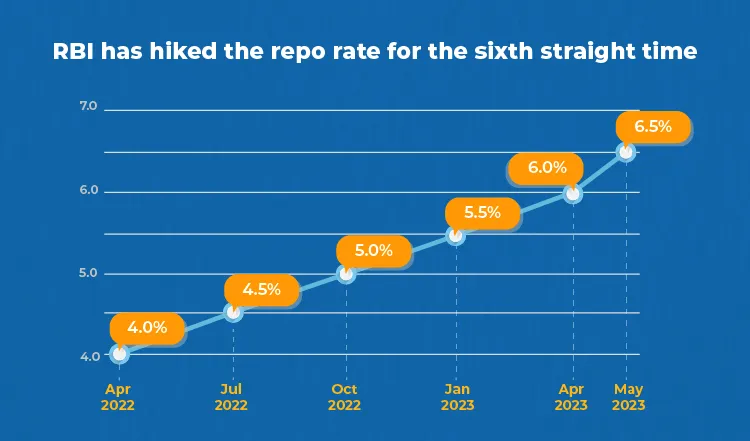

3. Mortgage Interest Rates

Interest rates significantly affect the affordability of homeownership. A 0.5% change in the interest rate can save or cost lakhs over the term of your mortgage. In India, home loan interest rates currently range from 8% to 10%, but they fluctuate depending on economic conditions and RBI guidelines. A 1% increase in the interest rate on a ₹30,00,000 loan over 20 years could increase your monthly EMI from ₹25,000 to ₹28,000. Over the life of the loan, this could mean paying ₹7,20,000 more.

4. Property Taxes

One expense often overlooked by first-time buyers is property tax. These annual taxes depend on the location and the property’s value. For instance, in cities like Delhi and Mumbai, property taxes are higher than in smaller cities like Jaipur or Lucknow. For example, in Mumbai, property tax is approximately 1.4% of the property’s market value, while in Jaipur, it might be around 1%. On a property worth ₹50,00,000, the annual tax could range from ₹50,000 to ₹70,000.

5. Homeowners Insurance

In India, homeowners insurance covers risks such as fire, theft, and natural disasters. Premiums are based on the home’s value, location, and the extent of coverage. It’s a necessary safeguard for your investment, but it adds to the monthly or annual costs of homeownership.

Tip: Bundle your homeowners’ insurance with other policies (e.g., life insurance) for potential discounts. Shopping around with multiple insurers can also reduce your premium.

Lifestyle Considerations

Beyond the financials, owning a home offers distinct lifestyle advantages and limitations. Let’s break down some of the key factors to consider.

1. Customization

As a homeowner, you have the freedom to renovate and customize your home to suit your preferences. Whether it’s remodeling your kitchen, adding a new bathroom, or building an outdoor space, you’re in control.

On the flip side, renovations come with hefty price tags. Adding a new bathroom or expanding a kitchen could cost anywhere between ₹1,00,000 to ₹5,00,000 depending on the quality of materials.

2. Community Involvement

Homeownership can create a stronger sense of community. When you own property in a specific area, you’re more likely to invest time and energy into the neighborhood. You may also become more engaged in local activities or residential societies.

For example, In Jaipur, many gated communities organize festivals, gardening clubs, and even security committees, giving homeowners a chance to build long-term relationships with neighbors.

3. Stability

Owning a home gives you a sense of permanence. It’s a place where you can raise your family, plant roots, and build memories. However, with stability comes a trade-off—lack of mobility. Selling or renting out your property takes time, and you might not be able to move easily if your job or family situation changes.

Long-Term investment

Buying a home can serve as a wealth-building tool, but how does it function as an investment in India? Let’s explore the financial benefits of owning property over time.

1. Equity Growth

Equity refers to the portion of your home you own outright. As you pay down your mortgage and as property values rise, your equity grows. In many Indian cities, property values appreciate by 5% to 10% annually, especially in growing metros like Pune, Hyderabad, and Bangalore. For example, If you bought a ₹30,00,000 home in Jaipur in 2010, its value today could be upwards of ₹45,00,000. That’s ₹15,00,000 in equity gained over 10 years.

2. Forced Saving

Every mortgage payment you make helps you build equity, which can be seen as a form of “forced savings.” Unlike renting, where your money goes into the landlord’s pocket, owning a home forces you to save for the future. In the long run, this can be a disciplined way to build wealth.

3. Leverage

One of the biggest advantages of homeownership is leverage. You can use your home’s equity to secure loans at lower interest rates for future investments, renovations, or even education costs.

Renting a Home in India: Flexibility and Freedom

While buying a home is a long-term commitment, renting provides short-term flexibility. If you’re not ready to settle down or don’t have enough savings for a down payment, renting might be the better option for you. Here are the key considerations when renting a home in India.

Financial Flexibility

1. Lower Upfront Costs

Renting requires far less upfront investment than buying. You’ll typically need to pay a security deposit (equal to 1-2 months’ rent) and the first month’s rent upfront, which is far more affordable than a 20% down payment for buying. For example, If you’re renting a 2-bedroom apartment in Jaipur for ₹25,000 per month, your upfront costs would be around ₹50,000 (₹25,000 for a security deposit and ₹25,000 for the first month’s rent).

2. Easier Relocation

Renting offers greater mobility. If your job requires you to move frequently or you’re uncertain about your long-term plans, renting gives you the freedom to relocate without the hassle of selling a home or dealing with property agents. Have you considered how often you might need to move for work? If your career involves frequent transfers, renting might be a more practical choice than buying.

3. No Maintenance Costs

One of the perks of renting is that your landlord is typically responsible for major repairs and maintenance. You don’t have to worry about fixing a leaky roof or replacing old plumbing. This can save you considerable time and money.

For example, living at a rented place, you don’t have to worry about fixing apartment’s air conditioning system when it gets broken during the summer—the landlord handles all repairs at no extra cost.

4. No Property Taxes

As a renter, you don’t pay property taxes, which is a significant expense for homeowners. In cities with high property taxes, this can be a considerable saving.

Lifestyle Considerations

1. Limited Control

While renting gives you financial flexibility, it comes at the cost of control over your living space. Most landlords don’t allow major modifications like painting walls or renovating, so you may feel restricted in making the space your own.

2.Rent Increases

In many Indian cities, rent increases annually, typically by 5% to 10%. While some states like Maharashtra have rent control laws, most cities allow landlords to increase rent based on market conditions.

In cities like Mumbai and Delhi, rents have seen a steady increase of 6% to 8% per year over the last decade, making it more expensive for long-term renters.

3. Lack of Stability

Renters can face the possibility of eviction or the need to move due to unforeseen circumstances. If your landlord decides to sell the property or increase the rent beyond your budget, you may have to relocate with little notice.

Comparative Factors to Consider

1. Your Financial Situation

Buying a home requires long-term financial planning. Ask yourself:

- Do you have enough saved for a down payment?

- Can you comfortably afford monthly mortgage payments?

- Are you financially stable with a steady income?

Use this checklist to assess whether you’re financially ready to buy a home.

2. Your Lifestyle and Future Plans

If you’re planning to settle in one location for the next 10-20 years, buying might make sense. But if you anticipate frequent moves or enjoy the flexibility of changing neighborhoods, renting could be a better fit.

3. The Housing Market

The real estate market fluctuates, and home prices can rise or fall based on economic factors. Research the current housing trends in your desired location to see whether it’s a good time to buy or rent.

Conclusion

Ultimately, the decision to buy or rent a home in India is a deeply personal one, shaped by your financial situation, lifestyle, and long-term goals. Buying a home offers stability, potential financial growth, and a sense of ownership, while renting provides flexibility, lower upfront costs, and fewer responsibilities. Whether you choose to buy or rent, it’s essential to conduct thorough research, consider the market conditions, and plan for the future.

Take your time and weigh the pros and cons before making your decision. Each path has its benefits, but the best option depends on your unique circumstances.

Frequently Asked Questions

- How much should I save for a down payment when buying a home in India?

Typically, you should save 10% to 25% of the property’s purchase price as a down payment. The exact amount depends on the lender and the loan structure.

- What are the hidden costs of buying a home in India??

In addition to the down payment, buyers should consider closing costs, registration fees, stamp duty, property taxes, and homeowners insurance, which can collectively add 5% to 12% to the total purchase price.

- How do mortgage interest rates affect my home purchase?

Mortgage interest rates determine the cost of borrowing money. A higher interest rate means higher monthly payments, while a lower rate can save you lakhs over the loan term.

- Can renting be a good option for the long term??

Yes, renting can be ideal for those who value flexibility, anticipate frequent relocations, or want to avoid maintenance and property taxes. However, rent increases and lack of equity growth are important factors to consider.

- Is it better to buy or rent a home in India??

This depends on your financial situation, lifestyle preferences, and long-term goals. Buying offers stability and potential equity growth, while renting provides flexibility and lower upfront costs.